PROBLEMS OF THE ORGANIZATION OF STRATEGIC MANAGEMENT FOR CROSS-BORDER SETTLEMENTS IN MODERN SANCTIONS CONDITIONS

Alexey V. Osipov

Admiral Nevelskoy Maritime State University, Vladivostok

Andrey A. Konotop

Admiral Nevelskoy Maritime State University, Vladivostok

Anastasia A. Vasilyeva

Master’s Degree from the Pedagogical University of Central China, Wuhan

Abstract: In the article there are examined the issues of complicated cross-border settlements in the currencies of Russia, the USA, the EU and China between Russia and China (PRC), as well as the systems of sanctions measures applied by Western countries to Russia and the system of secondary sanctions against states, organizations that carry out and continuing cooperation and interaction with Russian companies and individuals under sanctions. Some technologies and mechanisms of transactions are considered. As a result, an approach to change the strategic management system is proposed.

Keywords: trade with China, trade turnover with China, the 14th package of sanctions against Russia, proactive management, foresight technologies in financial planning

Introduction

The purpose of this article is to understand the ongoing foreign economic events and their impact on the business processes of domestic commercial organizations engaged in foreign trade activities. The object of the research is the management of companies as a decision-making system. The subject is the adaptive capacity of the decision-making system and its prospective organizational and structural transformation.

The methods of analysis, disparate data on the foreign trade indicators of the United States, the EU, China and Russia, the analysis of legal information and analytics on the sanctions mechanism of pressure on the Russian economy were applied, the currently operating mechanisms of international settlements were formalized and, through determination, a conclusion was drawn about promising transformations in the strategic management systems of companies.

The article consists of four parts. After the introduction, the main part examines the economic and statistical indicators and dynamics of the foreign trade balances of the United States, the EU, China and Russia, and forms an interim conclusion on the structural imbalance of the global trade balance and changes in promising strategic positions in the world. The second section of the main part reveals the mechanism of direct and secondary sanctions on the Russian economy and their impact on Chinese financial institutions and financial intermediaries. The third section of the main part reveals the adaptation mechanisms of foreign trade financial settlements and other offsetting mechanisms in foreign trade transactions. In conclusion, a conclusion is formed about a promising strategic change in the management of companies.

Strategic Partnership between Russia and China

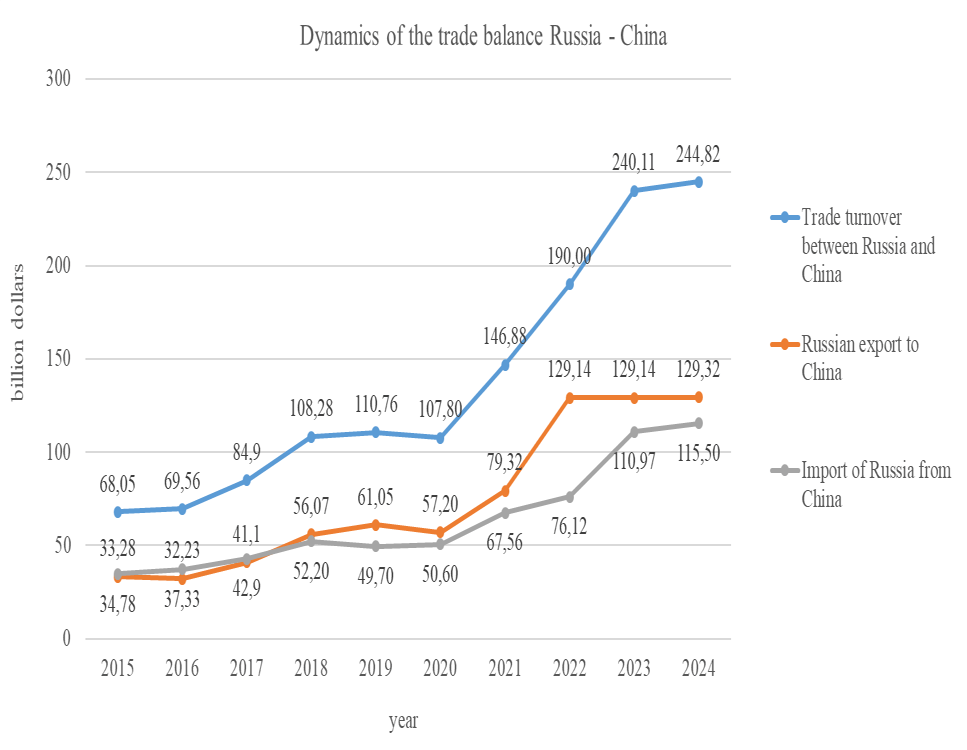

As of 2024, China is Russia’s main trading partner, with which trade is growing every year. Russia exports energy resources to China – oil, natural gas, coal, other valuable minerals and low-value-added products: copper, wood, semi-finished wood fuels and marine biological resources. From China, Russia receives a wide range of industrial, processing, and power equipment, cars, computer and office equipment, smartphones, and other wide range of consumer goods. According to some estimates, the volume of exports of goods from China to Russia for household and consumer goods is growing faster than the volume of the B2B e-commerce market as a whole, which leads to the conclusion that significant inventories and even surpluses are being formed in Russia [1]. It is noteworthy that the authors have not found any systematic domestic statistics on trade relations between the centers of the world economy, similar to the one conducted by the Chinese Customs Administration.

According to analysts from the Chinese Customs Administration, despite the volatile dynamics, the trade balance of exports and imports between the countries remains. At the same time, despite the stabilization of trade volumes, Russia’s income decreased from 2022 to 2023 by about two times to $18.17 billion, due to lower energy prices, which are the main part of Russian supplies to China in value terms [1]. The Chinese Customs Administration notes that due to uneven supplies from Russia, not all demand is covered, and Russia’s foreign exchange earnings are also decreasing while maintaining the same sales volumes of petroleum products. These conclusions are confirmed by an analysis of the revenue components of the Russian budget.

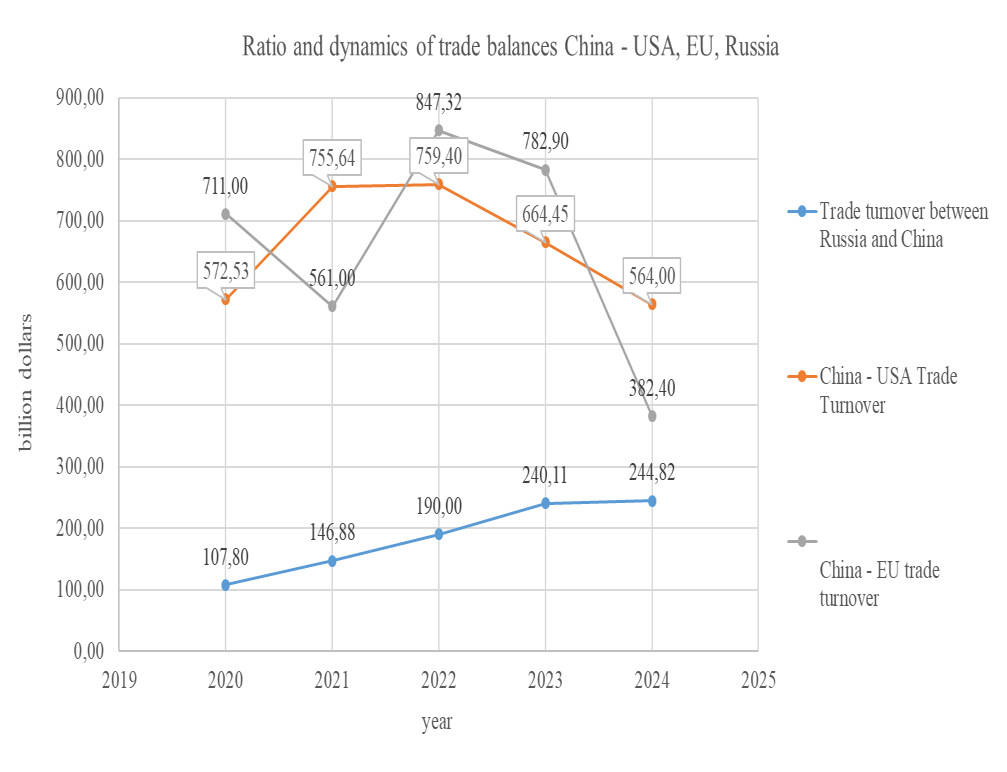

Also, for a more objective assessment of the functioning conditions of the national economy and its subjects, let us turn to the analysis of the world trade balance in terms of relations between China, the United States, the EU and Russia. Below is a chart of the dynamics of the countries’ trade balances, the data for which were compiled by the materials of the state news agency TASS [2].

From the data presented, it can be seen that earlier, for example, in 2020, Russia’s share in the trade balance was about 0.1 of the total trade, today it reaches 0.4. As you can see, China-EU trade has more than doubled over the past year, and turnover with the United States is gradually decreasing. Conclusions can be drawn from the above about the upcoming structural restructuring of the global economy, in which the United States, the EU and China will have other roles. It can be seen that China is losing its former export positions, at least with the United States and the EU (the Southeast Asian countries remain outside the scope of the analysis), while Russia does not have a similar market capacity and effective demand. In this context, Russia’s place should be considered, which has potential and opportunities for proactive economic development in the future, since the trade war between the United States and China will critically affect the Russian monoexport economy.

Sanctions pressure on the Russian economy and business

Further in the article, the issues of sanctions pressure from the international community against Russia and the specifically established “ceiling on oil prices” will be considered. And here it is necessary to cross out the semantic load of this phenomenon, since national oil revenues are formed based on the selling price, and profit from the selling price minus cost. In turn, we know oil prices, but the cost of its production does not allow Russia to be on a par with the main global exporters in terms of margins, as the cost of production in Russia, by various holdings, ranges from $ 40 to $ 55 per barrel, while the cost of production in the UAE and Saudi Arabia is up to $ 5 per barrel. [3].

The contradictions of globalization, the rapid technological and economic development of a number of countries are shaping transformations in the political and economic sphere and changing centers of power. The economic and political potential of the centers of power leads to an aggressive policy towards potentially less developed economies. One of them is “sanctions”.

Sanction (from Latin. “sanctio” – the strictest decree) is a measure of influence or methods applied to violators of established norms: an economic agent (an individual or legal entity, a branch of the economy or the state) and entailing certain consequences. According to the form of consolidation, sanctions can be expressed in the form of a fine, a ban, or restrictions on any operations [4]. The most commonly used measures to influence the blocking sanctions of the United States and the EU against Russia are the freezing of assets in the United States and the EU, and the prohibition of financial transactions and transactions. prohibition of entry to the territory of the USA and the EU for individuals. The hegemon of the global economy, the United States, is most actively resorting to the use of economic sanctions, which is explained by the dominant role of the US dollar in the global economy and the involvement of global players in the dollar currency system, for example, more than 60% of global foreign exchange reserves are held in the US currency. The high proportion of dollar-based international settlements increases the ability to establish requirements for the use of currency and identify violations of sanctions regimes within the country and in the global financial system, minimizing the likelihood of circumvention of sanctions.

The influence of the United States is so great and extraterritorial that the instrument of secondary sanctions against “third parties” is becoming a much more effective instrument of pressure. Organizations and individuals engaged in economic relations with the sanctioned organization are subject to secondary sanctions. Secondary sanctions are also implemented through the mechanism of monetary fines against violating companies. This measure is more lenient and flexible than blocking sanctions, its purpose is to prevent violations of the sanctions regime.

Russia has been subjected to the most serious sanctions by the United States and the EU since 2014 in connection with the annexation of Crimea by Russia in 2014 and the events in Donbass. The most significant ones can be considered to be those announced on June 12, 2024 by the US Financial Assets Control Authority, which include restrictions on access to American software and IT services, as well as affecting more than 300 individuals and legal entities in Russia and abroad (in the Middle East, Europe, Africa, Central Asia, Caribbean countries), which provide assistance to the Russian military-industrial complex and help it circumvent US sanctions restrictions. Additional measures have also been taken to increase the risks of secondary sanctions for foreign financial institutions linked to the Russian military-industrial complex. These restrictions are aimed at the financial, defense, manufacturing, technological and mining sectors and are aimed at reducing Russia’s future revenues from exports of liquefied natural gas. It is noteworthy that these restrictions are aimed specifically at Russia’s future supplies and revenues.

(End of introductory fragment)