NEW ZEALAND SHIPBUILDING AND REPAIRING INDUSTRY

Vadim Ye. Isayev

Non-staff correspondent on South-Pacific region

Abstract: This is a second review material prepared by Vadim Ye. Isayev, the first executive editor of “Asia-Pacific Journal of Marine Science&Education”, now our non-staff correspondent on South Pacific region, in Auckland, New Zealand. The first one has been published in our Journal, vol.14, number 2, 2024.

Keywords: New Zealand, shipbuilding, repair, vessels, boats, national economy

Introduction

New Zealand’s extensive coastline and dense forests proved a lucky combination for enterprising colonists. They set up shipyards around the country, turning out the handy wooden cutters, schooners and scows that served a busy coastal trade for decades. Ships and boats are still built locally, and Kiwi designers have produced a revolutionary jet boat and world-beating fiber-glass yachts.

So, New Zealand’s shipbuilding industry has a rich history, evolving from early timber vessels to modern specialized crafts. In the 19th century, settlers constructed ships using native timber to facilitate coastal trade. By 1911, the country had 29 shipyards employing 589 individuals, launching a variety of vessels, predominantly under 50 tons.

In contemporary times, the shipbuilding and repair industry in New Zealand comprises approximately 43 businesses, employing around 600 personnel as of 2023 according to the IBISWorld analytical report. While exact annual graduation figures in maritime disciplines are not specified, the industry continues to develop a skilled workforce to meet its needs.

Shipbuilding and Repair Capabilities in New Zealand

New Zealand has a well-established maritime industry, known for its high-quality craftsmanship and focus on smaller to mid-sized vessels with a focus on superyachts, ferries, fishing boats, and research vessels.

The facilities and expertise in New Zealand are world-class for vessels within a specific size and displacement range.

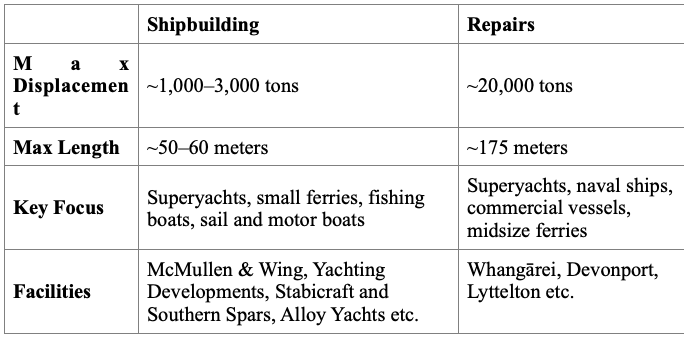

New Zealand shipyards can build vessels with a maximum displacement of approximately 1,000–3,000 tons and size up to 50-60 meters in length. In exceptional cases, custom yachts slightly exceeding this length have been built. Larger vessels are generally built overseas due to infrastructure and resource limitations.

New Zealand’s ship repair industry is robust and capable of servicing a variety of vessels, including superyachts, naval ships, fishing boats, and commercial vessels. The major repair facilities are concentrated in key locations such as Auckland and, Whangārei at North Island, as well as Lyttelton in Christchurch, South Island.

New Zealand’s repair facilities accommodate and manage ships and vessels with a displacement of up to 20,000 tons and length up to 170 meters. This includes mid- sized cargo ships, most of ferries, fishing and survey vessels, as well as frigates, amphibious ships and naval vessels from the Royal New Zealand Navy. This size limitation aligns with the dry dock (two in general) and lifting infrastructure available at major ports (Devonport in Auckland and Littelton in Christchurch).

E.g. they cannot provide a full scale of repair works in dry docks for major inter islander rail and vehicle ferries because their sizes exceeding dimensions of the largest Devonport dry dock Calliope.

Main repair capabilities include hull maintenance (cleaning, anti-fouling, painting, structural repairs and advanced coatings for radar reduction), mechanical and engine repairs (overhauls of propulsion systems, generators, and auxiliary systems), electrical and navigation systems (repairs and upgrades to navigation, sonar, power distribution systems and weapon mounts for naval ships), refits and modifications (comprehensive refits for superyachts, including interior modifications and mission-specific upgrades for naval and commercial vessels).

It is necessary to note that New Zealand’s shipyards play a key role in maintaining and repairing naval vessels for the Royal New Zealand Navy and allied nations. The country has the infrastructure and expertise to handle a range of naval ships, from patrol boats to multi-role vessels and amphibious ships.

Comparison Table: Shipbuilding vs. Repairs

Noticed some growth in development last years, however, shipbuilding industry has faced challenges recently, with a decline in demand for new vessels and increased competition from other countries, such as China, Vietnam, Australia, who actually provide a range of high displacement vessels. As a result, some shipbuilding companies have diversified their services to include ship repair and maintenance.

The ship repair sector is more prominent, offering services to both domestic and international clients. New Zealand’s ship repair industry has a reputation for high-quality workmanship and competitive pricing, making it an attractive destination for ship owners and operators. The industry has also benefited from the country’s strategic location, with many vessels passing through New Zealand on their way to other destinations.

However, Australia/Oceania is not famous for a comprehensive offer of ship repair facilities. The biggest graving dock is provided in Brisbane/Australia for vessels of up to 85,000 dwt. New Zealand has only smaller docking facilities up to 26000 dwt, by one at each island. Remarkably with Papua New Guinea Dockyard Limited even a very small country of this area has its own comparable docking facility.

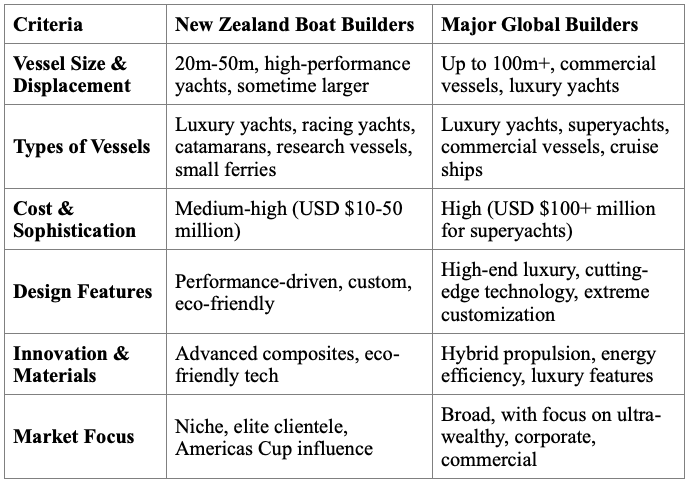

NZ Boat Building

New Zealand has about 36 companies building boats and small vessels, but only a few notable ones. They are generally much smaller in scale compared to major boat construction hubs around the world, such as those in the U.S., Europe, and Asia. Here’s a comparison between New Zealand’s boat builders and major international counterparts, highlighting capabilities such as vessel size, type, cost, sophistication, design features, and other aspects.

- New Zealand.

NZ boat builders primarily focus on custom yachts, luxury vessels, high-performance racing sail and motor boats, catamarans, and research vessels. Notable builders include McMullen & Wing, Hakes Marine Alloy Yachts, Southern Ocean Shipyard, and Yachting Developments. Vessels tend to range from 20m to 50m in length, with some exceptional custom builds reaching beyond that, but large commercial ships or oil tankers are not typically built here, but generally in China, South Korea, Vietnam, etc.

NZ builders are known for their quality craftsmanship, attention to detail, and innovative use of materials, particularly for custom designs. The costs for New Zealand’s yachts are high but often fall within the medium-to-high range for luxury yachts due to the bespoke nature of the projects. The use of aluminum, composite materials, and advanced systems for both sailing and motor yachts is common. For instance, Alloy Yachts has built superyachts in the range of USD $10-50 million.

New Zealand’s yacht builders are recognized for innovation, particularly in the racing and high-performance sectors. Many builders incorporate advanced hull designs (e.g., hydrodynamics for faster performance), lightweight composite materials, and eco-friendly technologies, including hybrid propulsion and solar energy systems. Additionally, they tend to focus on making yachts with excellent handling and sea-keeping abilities.

New Zealand has a strong reputation in the luxury and racing sectors. It is a leader in the America’s Cup yacht racing scene, contributing to the global development of advanced yacht designs and technology. Builders like Southern Ocean Shipyard have developed strong reputations for crafting top-tier yachts tailored for elite clientele, though on a smaller scale than their global counterparts.

- Major Global Builders.

In comparison with the NZ shipbuilders, large international boat constructors like Lürssen (Germany), Feadship (Netherlands), and Benetti (Italy) build yachts and superyachts up to 100 meters or more. These companies also have the capability to build large commercial ships, including luxury cruise liners, naval vessels, and industrial ships with massive displacements (over 10,000 tons).

On the global stage, builders like Oceanco (Netherlands), Heesen Yachts (Netherlands), and Sunseeker (UK) offer a wider range, from small luxury yachts to extremely large superyachts, and some focus on commercial vessels (e.g., Royal IHC for dredgers and offshore vessels, Daewoo Shipbuilding & Marine Engineering for tankers and LNG carriers).

Regarding costs, major international builders like Lürssen or Feadship often build ultra-luxury superyachts costing upwards of USD $100 million. These yachts include highly sophisticated engineering, cutting-edge design features, and advanced technological integration, with highly customized interiors, elaborate finishes, and highly efficient propulsion systems.

The design features of global giants such as Benetti and Oceanco tend to focus on both extreme luxury and technological advancements. These include larger, more luxurious interiors, advanced automation, and high-end systems for comfort, safety, and performance. These ships often incorporate innovations in energy efficiency, sustainability (e.g., hybrid propulsion systems), and smart technology, with cutting-edge designs by top designers.

In comparison with NZ boatbuilders, large global brands are more focused on a broad range of vessels from luxury yachts to cruise liners and commercial vessels. They tend to target the global elite, including royalty, billionaires, and large corporations, with a higher volume of production.

In conclusion, New Zealand boat builders are world-class in their specialization of luxury yachts, racing vessels, and high-performance boats, often leveraging cutting-edge technology for their specific designs. However, compared to major global players, they are more niche in scope, focusing on smaller, custom builds, rather than large-volume, massive commercial vessels or ultra-luxury yachts.

Summary Table

Due to capability limitations in the shipbuilding industry New Zealand imports large ships and vessels primarily from abroad to meet own maritime needs in large tankers, passenger liners and cargo ships. So, as per 2020 China was the largest supplier, providing approximately $7.74 million worth of cargo vessels other than tankers or refrigerated ships. Next was Vietnam, who supplied around $2.81 million worth of cargo vessels in the same year. Further places were shared between Australia and The Netherlands that contributed about $30,600 and $810 worth of cargo vessels to New Zealand in 2022 consequently.

Impact on the National Economy

The shipbuilding and repair industry is a key part of New Zealand’s marine sector, contributing significantly to the economy. In 2023, the broader marine industry was valued at NZD 3 billion annually, with NZD 2.2 billion from domestic sales and NZD 800 million from exports. The shipbuilding and repair sector generated NZD 208.5 million, with a modest annual revenue growth of 0.2% over the past five years, largely due to increased defense spending. However, most of these funds have been allocated to repair services rather than new shipbuilding.

Regionally, Whangarei plays a crucial role, accounting for 62% of boatbuilding and 95% of shipbuilding activity, contributing NZD 9.06 million to the local economy. The superyacht sector also made a significant impact, adding NZD 212 million to the economy in the 2023/24 season.

With continued government investment, private sector innovation, and a focus on specialized services, the industry is poised for steady growth.

Industry Growth and Projections

Recent Growth: Industry revenue grew at an average annual rate of 4.5% over the past five years, reaching NZD 212.2 million in 2023-24, primarily driven by defense spending and repair services.

Future Outlook: Growth is expected to continue due to ongoing defense investments and increased global maritime trade.

Government & Private Investment: The Defence Capability Plan 2019 prioritizes naval upgrades, though funds have mainly gone to repairs. Companies like Vessev attract venture capital for innovations like electric hydrofoil marine craft.

Profitability: Rising revenue per employee suggests improved productivity and profitability.

Market Size & Industry Challenges

The industry saw an 11.2% decline in 2023 but is projected to recover over the next five years due to increasing demand for repairs and defense spending.

Key Challenges:

- Global Competition. The global shipbuilding market is highly competitive, with countries like China, South Korea, and Japan dominating large-scale ship production. New Zealand’s industry, focusing on smaller vessels and specialized repairs, must navigate this competitive landscape.

- Volatile Revenue Streams. Over the past five years, the industry has experienced fluctuating revenues. While increased defense capital spending has bolstered services catering to the defense sector, much of this funding has been allocated to repair services rather than new shipbuilding projects.

- Economic Pressures. High inflation and elevated construction costs have posed significant challenges to the broader construction sector in New Zealand, indirectly affecting the shipbuilding and repair industry.

While facing challenges, the New Zealand shipbuilding and repair industry is positioned for long-term growth, driven by defense investments and expanding maritime activities. Babcock (NZ) remains a key player in this moderately competitive market.

Innovation and development programs

New Zealand’s shipbuilding and repair industry is actively pursuing several innovative and developmental initiatives to enhance its capabilities and sustainability:

- Sustainable Marine Technologies.Auckland-based company EV Maritime is at the forefront of developing electric ferries aimed at decarbonizing urban harbors. Their efforts support boat builders globally in transitioning to high-quality electric vessel construction.

- Infrastructure Development.The Northport dry dock facility project – progress is underway on a detailed business case for establishing a dry dock and marine maintenance facilities at Marsden Point in Northland, Wangarei (North Island). This facility aims to service New Zealand’s largest current and planned vessels, including international and navy ships. The project includes dredging, reclamation, a 250-meter floating dry dock, and a permanent maritime maintenance facility. This development aims to bolster local marine maintenance capabilities and stimulate regional economic growth.

- Advanced Manufacturing Support.NZ Product Accelerator – this program offers support to manufacturers in areas such as 3D printing, big data, and advanced manufacturing materials. It provides specific research expertise in hybrid digital manufacturing technologies, benefiting the shipbuilding sector by fostering innovation and enhancing production processes.

- Marine Industry Training. Marine and Specialized Technologies Academy (MAST) – MAST trains up to 700 marine innovation specialists and boatbuilders annually. This program has been syndicated globally, underscoring New Zealand’s dedication to advancing marine technology and craftsmanship.

- Advanced Manufacturing and Innovation Support. Focused Innovation Policy – the New Zealand government is implementing focused innovation policies to collaborate with industry stakeholders, knowledge institutions, and other parties. This approach aims to realize the potential for innovation within the shipbuilding and repair sector, fostering advancements in technology and processes.

Ecological and Sustainable Initiatives

New Zealand’s shipbuilding and repair industry is actively implementing ecological and sustainable initiatives, alongside adopting new technologies to enhance efficiency and reduce environmental impact, positioning New Zealand as a leader in eco-friendly and innovative maritime practices.

- 1.Green Shipping Corridors: New Zealand is at the forefront of establishing green shipping corridors, aiming to decarbonize maritime transport. These corridors prioritize zero-emission vessels and sustainable practices, contributing to global environmental goals.

- 2.Electric Hydrofoil Ferries: Innovations like the development of electric hydrofoil ferries are underway, designed and built by Vessev. A notable example is a nine-meter-long, 10-passenger electric foiling ferry set to enter commercial service in Auckland by December 2024 and started cruising in January 2025. This initiative represents a significant step toward net-zero emissions in maritime transport.

- 3.Inshore Fishing Fleet Modernization: Proposals have been made to build a new fleet of inshore fishing vessels in Northland. These vessels are designed to provide a pathway to zero carbon emissions within 15-20 years, aligning with sustainable fishing practices and reducing the industry’s carbon footprint.

Conclusion

Overall, while New Zealand’s shipbuilding industry may not be large, it remains an integral part of the nation’s maritime heritage and economy, adapting to modern demands and technological advancements.

In conclusion, the shipbuilding and repair market in New Zealand is diverse and competitive, with a range of companies offering high-quality services to both domestic and international clients. While the shipbuilding industry has faced challenges in recent years, the ship repair industry has continued to thrive, thanks to its reputation for quality workmanship and competitive pricing.

There are significant opportunities to expand naval repair capabilities and position New Zealand as a hub for sustainable and advanced maritime services in the Pacific region.

REFERENCES

1.Gavin McLean, ‘Shipbuilding’, Te Ara, the Encyclopedia of New Zealand, URL:

http://www.TeAra.govt.nz/mi/shipbuilding/print

2.Trusted Docks – Shipbuilding & Repair Catalog, URL: https:// http://www.trusteddocks.com/catalog/sailingarea/1319

3.Countries That Dominate Global Shipbuilding – Visual Capitalist, URL:

https:/ /www.visualcapitalist.com/countries-dominate-global-shipbuilding/

4.Babcock NZ – NZ Marine Directory, URL:

https:// http://www.nzmarine.com/directory/business/babcock-nz

5.Titan Marine Engineering, URL:

https://titanmarine.co.nz/

6.Oceania Marine Location & Facilities, URL:

https://oceaniamarine.co.nz/location-facilities/

7.Ship Repair New Zealand, URL:

https://www.shiprepair.co.nz/

8.Vessel Works Tauranga, URL:

https://www.vesselworks.co.nz/

9.Superyacht Services Guide, URL:

https://www.superyachtservicesguide.com/20/9119/directory?category=1536&location=820

10.Stark Bros – Ship Repair, URL:

https://www.starkbros.co.nz/index.php/services/ship-repairs

11.TS Marine, URL:

https://www.tsmarine.co.nz/

12.Seaview Marina – Wellington Marine Centre, URL:

https://www.seaviewmarina.co.nz/Onsite%2BRetail/Wellington%2BMarine%2BCentre.html

13.Chaffers Marina Contractors:

https://chaffersmarina.co.nz/chaffers-marina-contractors/

14.IBISWorld – Shipbuilding & Repair Services in New Zealand, URL:

https://www.ibisworld.com/new-zealand/industry/shipbuilding-and-repair-services/255/

15.New Zealand Marine Industry Hits USD 3 Billion – Sail-World, URL:

https://www.sail-world.com/news/265528/New-Zealand-marine-industry-hits-USD3-billion

16.Cargo Vessels Profile – OEC World, URL:

https://oec.world/en/profile/bilateral-product/cargo-vessels-other-than-tanker-or-refrigerated/reporter/nzl

17.New Zealand Construction Outlook for 2025 – BCI Central, URL:

https://www.bcicentral.com/news/new-zealand-construction-outlook-for-2025/

18.Global Market Report: Shipbuilding & Repairing – The Business Research Company, URL:

https://www.thebusinessresearchcompany.com/report/ship-building-and-repairing-global-market-report

19.Shipbuilding and Repair Services – Research and Markets, URL:

https://www.researchandmarkets.com/reports/5513438/shipbuilding-and-repair-services-in-new

20.Lyttelton Port Company – Dry Dock Services, URL:

https://www.lpc.co.nz/our-services/dry-dock/

21.Lyttelton Information Centre – Graving or Dry Dock, URL:

https://www.lytteltoninfocentre.nz/graving-or-dry-dock

22.Northland’s Dry Dock Costs – NZ Herald, URL: :

https://www.nzherald.co.nz/northern-advocate/news/northlands-dry-dock-to-cost-at-least-500-million-to-build/4L4W7S5IOJE3TFRRC47YJMJGHA/

23. Devonport Naval Base – NZDF, URL:

https://www.nzdf.mil.nz/defence-and-whanau/where-we-are/devonport/

24. Superyacht Attraction Initiatives in NZ – MySailing, URL:

https://www.mysailing.com.au/superyacht-attraction-initiatives-paying-off-as-nz-marine-reports-212m-superyacht-economic-boost-to-new-zealand/

25. Northport Dry Dock Business Case – Beehive, URL:

https://www.beehive.govt.nz/release/northport-dry-dock-business-case-progressing

26. New Zealand’s Groundbreaking Marine Products – Marine Business World, URL:

https://www.marinebusinessworld.com/news/265567/New-Zealands-groundbreaking-marine-products

27. NZ Product Accelerator, URL:

https://www.nzproductaccelerator.co.nz/

28. Green Shipping Corridors – Stellar International, URL:

https://stellarint.co.nz/news/green-shipping-corridors-new-zeland-plan-to-improve-shipping-lines/

29. Net Zero Ferry Future in NZ – Riviera, URL:

https://www.rivieramm.com/news-content-hub/news-content-hub/apple-watch-alumni-and-fullers360-pave-way-for-new-zealands-net-zero-ferry-future-82675